Cross-border electricity interconnections between the European Union (EU) countries and non-EU neighbours in the Mediterranean region are essential infrastructure. As Europe continues to accelerate its decarbonisation efforts and integrate increasing levels of variable renewable energy, these interconnections have become essential channels for ensuring security of supply, enhancing market liquidity, and supporting the integration of diverse power systems. Their function relies on a balance of engineering design, operational coordination, regulatory harmonisation, and market mechanisms.

The importance of interconnections between the EU and its neighbours in the Mediterranean region is the focus of a comprehensive report recently released by Med-TSO, which is the Association of the Mediterranean transmission system operators (TSOs) for electricity. The report titled “Rules applied to the interconnections between EU and extra-EU countries: Capacity allocation and management of interconnection congestion” has been published under the TEASIMED II (Towards an Efficient, Adequate, Sustainable and Interconnected Mediterranean Power System) project. TEASIMED II is an EU-funded initiative led by Med-TSO to enhance power grid integration, stability, and efficiency across the Mediterranean region through collaborative planning, grid code harmonisation, and pilot projects for interconnected zones, building on the previous TEASIMED report.

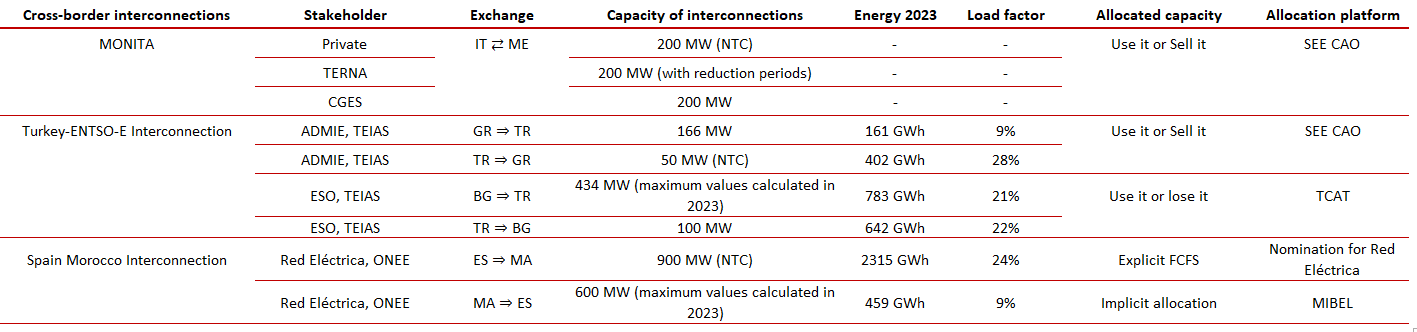

The latest report presents an in-depth analysis of cross-border electricity interconnections between EU and non-EU countries in the Mediterranean region, focusing on the cases of Italy–Montenegro (MONITA), Türkiye– European Network of Transmission System Operators for Electricity (ENTSO-E) (via Greece and Bulgaria), and Spain–Morocco. It highlights the technical, regulatory, and institutional frameworks that underpin these interconnections, examining how electricity is traded across borders, how transmission capacity is allocated, and how congestion is managed.

Figure 1: Map of interconnections between EU and non-EU countries studied by Med-TSO

Source: Med-TSO

Technical configuration

The technical configuration of electricity interconnections determines how power physically flows between systems, how controllability is achieved, and what operational constraints must be considered. The three interconnections examined—MONITA; Türkiye–Greece and Türkiye–Bulgaria; and Spain–Morocco—represent different technologies, grid topologies, and system-integration philosophies. Understanding their technical configuration requires defining several key concepts, such as high voltage alternating current (HVAC), high voltage direct current (HVDC), synchronous vs. asynchronous grids, thermal capacity, and power-flow controllability.

HVAC is the traditional method of transmitting electricity over long distances. HVAC links between synchronous grids allow real-time exchange of power based on frequency-driven physical laws. In synchronous systems, all interconnected zones operate at the same frequency, and power flows are determined automatically by network impedances rather than by operator instructions. HVDC in contrast, converts AC to DC at the sending end and back to AC at the receiving end. HVDC enables precise control of power transfer and allows the connection of asynchronous systems or systems operating at different frequencies. HVDC is also advantageous for long undersea cables (USC), where HVAC becomes inefficient due to reactive-power oscillations and capacitive charging currents.

Table 1: Specifications of the interconnections studied by Med-TSO

Note: OHL – overhead line; USC – undersea cable; UGC – underground cable; HVDC – high voltage direct current; HVAC – high voltage alternating current

Source: Med-TSO

The MONITA interconnection is purely an HVDC system and represents the most technologically advanced of the three. It consists of 423 km of undersea cable (USC) laid at depths reaching 1,215 metres beneath the Adriatic Sea, supported by approximately 22 km of onshore underground cable (UGC) – 16 km in Italy (from the coast to the Cepagatti substation) and 6 km in Montenegro (from the coast to the Lastva-Kotor substation). The first cable, with a capacity of 600 MW, was commissioned in 2019. In October 2025, the two countries signed a memorandum of understanding (MoU) to double the capacity to 1.2 GW. The cost of the second cable is estimated at EUR500 million and is expected to be commissioned in 2031.

Given that grids of Montenegro and Italy are not synchronously connected, HVDC technology provides an electrically decoupled connection, enabling stable power transfers without requiring frequency alignment. The HVDC converters also provide reactive-power compensation and limited voltage support, although the link primarily operates on fixed scheduled flows defined a day in advance. MONITA’s technical configuration, therefore, combines controllability, system decoupling, and suitability for extreme submarine installation.

The Türkiye–Greece–Bulgaria interconnection presents a different architecture. Türkiye is directly synchronised with ENTSO’s Continental Europe Synchronous Area (CESA) through three 400 kV OHL interconnections, forming one large AC system. This includes two interconnections at the Bulgarian border – Hamitabat (Türkiye)–Maritsa East (Bulgaria) I and II (159 km and 149 km) (single-circuit lines), and one at the Greek border – 128-km Babaeski (Türkiye)–Nea Santa (Greece) line. Power flows across these interconnections cannot be directly controlled because the systems are synchronous. It requires extensive coordination of generation dispatch, voltage control, and contingency handling to maintain security of supply. Synchronous interconnection also implies that disturbances in one country propagate instantly across the wider region, calling for harmonised operational standards.

The Spain–Morocco link includes a pair of 30-km, 400 kV HVAC undersea circuits, each rated at 700 MW, laid at depths of around 620 metres across the Strait of Gibraltar, transitioning to overhead lines onshore. In June 2006, the interconnector capacity or thermal rating doubled to 1.4 GW with the commissioning of a second HVAC connection of the same capacity. Operational limits—including transient stability, short-circuit levels, and voltage-profile constraints—result in net transfer capacity values significantly below the thermal rating: approximately 900 MW in the Spain-to-Morocco direction and 600 MW in the opposite direction.

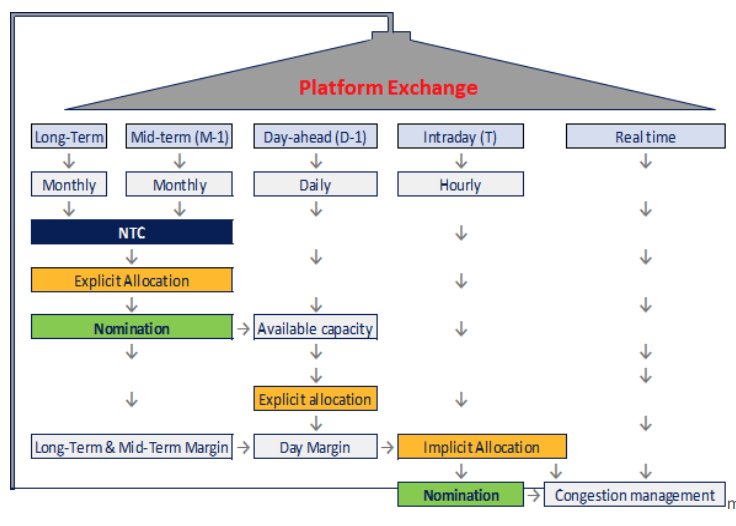

Capacity calculation and allocation

Capacity calculation determines the maximum amount of power that can be safely exchanged between two systems, while capacity allocation defines how market participants obtain the rights to use this capacity. These processes rely on critical technical terms that require clear definition. Total transfer capacity (TTC) is the theoretical maximum power transfer that the system can handle under steady-state conditions without violating thermal, voltage, or stability limits. Transmission reliability margin (TRM) accounts for uncertainties, such as forecasting errors or unplanned outages. Net transfer capacity (NTC) is defined as NTC = TTC – TRM, representing the commercially available cross-border capacity.

The capacity calculation for the analysed interconnections involves converting physical transmission grid restrictions into the maximum permissible volumes of commercial exchanges. These exchanges are carefully designed to ensure system security is not compromised. TSOs account for all relevant physical restrictions when calculating and notifying capacities, thereby eliminating the need for market allocation processes to make additional assumptions about grid scenarios.

MONITA uses an NTC approach consistent with European practice. Of the 600 MW available on the first HVDC pole, 200 MW are assigned to a consortium of private industries with an exemption to third party access (that is treated as a merchant line), whilst the remaining 400 MW are assigned in equal parts to the Italian and Montenegrin TSOs [200 MW each to Terna and Crnogorski Elektroprenosni Sistem (CGES)]. The transmission capacity assigned to TSOs is sold by the Southeast Europe Coordinated Auction Office (SEE CAO) through Physical Transmission Rights (PTRs) auctions, in line with the ‘Use it or sell it’ (UIOSI) principle. The latter implies that capacity holders who do not nominate their rights automatically receive compensation equal to the day-ahead market price differential or the auction clearing price. This principle prevents inefficient withholding of capacity and maximises utilisation. Because HVDC flows are fully controllable, capacity usage corresponds exactly to nominations, enabling accurate settlement.

For the Türkiye–Bulgaria interconnection, the respective TSOs [Turkish TEİAŞ and Bulgarian Electroenergien Sistemen Operator EAD (ESO EAD)] share the monthly and yearly NTCs equally. Thus, each TSO calculates the capacity to be offered to market participants for both monthly and yearly capacity allocation auctions based on their share of the NTC. TEİAŞ acts as the auction operator for this link and carries out the monthly and yearly auction processes for the NTC part of TEİAŞ. For the Türkiye – Greece interconnection, SEE CAO is the auction operator and the agreed monthly or yearly NTCs are submitted to SEE CAO without any NTC sharing. SEE CAO carries out the relevant monthly and yearly auction processes. After the completion of the long-term nomination process and the matching of these nominations by the TSOs, SEE CAO calculates the unused capacities for the Türkiye–Greece border, and TEİAŞ calculates the unused capacities for the Türkiye–Bulgaria border within the scope of TEİAŞ capacities using the TEIAS Capacity Auction Tool (TCAT) platform. Unused capacities are used in the calculation of the capacity to be offered to market participants in the daily auctions. Market participants that meet the necessary conditions can conduct cross-border electricity trade based on their short-term (daily) capacities (if any) or the short-term capacities of the companies which are counterparts in the other country. For this purpose, companies inform TEİAŞ by making nominations on the TCAT Platform by 14:00 CET/CEST the day (D-1) before the transfer day (D).

The Spain–Morocco border employs a hybrid mechanism combining explicit and implicit allocation. Spain uses a scheme where market participants may submit bilateral nominations with associated capacity bids. If total bilateral nominations remain below 50 per cent of the available transmission capacity, they are fully accepted, and the remainder is allocated implicitly through the day-ahead market via Operador del Mercado Ibérico de Energía’s (OMIE) market-coupling algorithm. OMIE is the nominated electricity market operator (NEMO) for Spain and Portugal. If nominations exceed 50 per cent, explicit daily auctions are triggered for the portion above the threshold. This hybrid method reflects the asymmetric market maturity of the two countries: Spain participates in a fully coupled European day-ahead market, while Morocco relies more on long-term contracts and centralised planning.

Table 2: Comparison between capacity calculation and main characteristics of three interconnectors

Note: CGES – Crnogorski Elektroprenosni Sistem; ESO – Electricity System Operator EAD; FCFS – first-come first-served; ADMIE – Anexartitos Diacheiristis Metaforis llektrikis Energiasis; MIBEL – Mercado Ibérico de Electricidad; NTC – net transfer capacity; ONEE – Office National de l’Électricité et de l’Eau Potable; SEE CAO – South East Europe Coordinated Auction Office; TEİAŞ – Türkiye Elektrik İletim A.Ş.; TCAT – TEİAŞ Capacity Allocation Tool; ONEE–l’Office National de l’Électricité

Source: Med-TSO, Global Transmission Report

Congestion management, curtailment, and congestion rents

Congestion arises when the nominated flows across an interconnection exceed its available capacity or when internal system conditions limit transfers. Unintended deviations occur when actual power flows differ from scheduled flows, especially in synchronous AC systems where physical flows cannot be fully controlled. For this, counter-trading involves adjusting generation or consumption in one or both systems to relieve congestion. Congestion rent is the financial surplus generated when price differences exist across a congested interconnection. These rents typically accrue to the TSOs.

MONITA’s HVDC architecture makes congestion management relatively straightforward. When outages or network changes require a reduction in NTC, Terna and CGES jointly determine the revised capacity and notify SEE CAO by D-2. In the event of an HVDC trip, congestion is managed through counter-trading, with the TSOs adjusting generation or demand to rebalance flows. The TSOs can also modify the HVDC set-point to limit power transfers and address internal security issues, a capability that highlights the controllability of HVDC systems. Congestion rents are allocated according to ownership. Congestion rents relative to the 200 MW capacity owned by Terna are used according to Article 19 of EU Regulation 2019/943, Art. 44.2 of Annex A to L’Autorità di Regolazione per Energia Reti e Ambiente (ARERA)Resolution n. 111 of 2006 and ARERA Resolution n. 162 of 2011. Congestion rents relative to the 200 MW capacity owned by CGES are deducted from CGES’s regulatory allowable revenue according to Art. 6.3 of the methodology for determining the regulatory allowed income and prices for the use of the electricity transmission system determined by Montenegro’s regulator Regulatorna agencija za energetiku i regulisane komunalne djelatnosti (REGAGEN) on July 5, 2022. The remaining 200 MW assigned to private investors are exempt from third-party access. The direct economic benefits relating to this capacity belong to such investors. Because HVDC minimises unintended deviations, only small residual imbalances occur, which are settled through the FSKAR methodology – financial settlement mechanisms of KΔf (capacity difference), ACE (area control error) and ramping period.

In the Türkiye–Greece and Türkiye–Bulgaria interconnections, congestion rents arise through the explicit yearly, monthly, and daily capacity auctions carried out by TEİAŞ and, for the Türkiye–Greece border, through SEE CAO. When the capacity offered is lower than the total volume requested by market participants, the marginal pricing mechanism establishes a single clearing price, generating congestion rents. These auction revenues are shared equally between the two neighbouring TSOs under a 50–50 allocation key. The national regulatory authorities (NRAs) determine the use of the auction revenues, directing them toward regulated purposes such as financing new interconnection projects, maintaining existing cross-border infrastructure, and ensuring the continued reliability of the transmission network.

Spain and Morocco manage congestion in their interconnection using redispatch as per Spain’s Operational Procedure 3.2. Congestion rents arise in specific conditions: only when explicit auctions are triggered due to bilateral nominations exceeding the 50 per cent threshold. Implicit market coupling, under normal circumstances, eliminates congestion rents by allocating flows efficiently at market-clearing prices.

Figure 2: Main aspects of capacity allocation

Source: Med-TSO

Best practices

Comparing the three interconnections yields several best practices relevant for future Mediterranean energy integration. HVDC emerges as a key technology for long-distance and intercontinental links. MONITA demonstrates its strengths: precise controllability, the ability to connect asynchronous systems, and reduced reliance on complex AC-system dynamics. As Mediterranean countries explore large-scale interconnectors between North Africa and Europe, HVDC will be the preferred choice for technical, economic, and operational reasons.

Regarding capacity allocation, the UIOSI principle clearly outperforms UIOLI as the former ensures that unused capacity returns to the market and that the capacity holder is compensated. It improves overall utilisation and transparency. UIOLI is administratively simpler but less efficient. MONITA and the Türkiye–Greece border show the benefits of UIOSI, while the Türkiye–Bulgaria border illustrates the limitations of UIOLI.

Implicit market coupling offers the highest economic efficiency because it allocates capacity according to real-time price differentials. The Spain–Morocco hybrid model provides a transitional solution where asymmetric markets coexist. Over time, expanding implicit allocation across Mediterranean borders will enhance welfare and support renewable integration.

Operationally, the importance of harmonised TTC/NTC methodologies cannot be overstated. MONITA benefits from Energy Community alignment (which involves neighbouring countries legally adopting EU energy laws through the Energy Community Treaty to integrate markets); Türkiye–Greece–Bulgaria interconnection relies on ENTSO-E standards; Spain–Morocco uses a bespoke bilateral process but still incorporates systematic security studies. Future interconnections will require Mediterranean-wide coordination entities to standardise methodologies and operational procedures.

Finally, deviation settlement mechanisms must be transparent, predictable, and aligned with market design. Financial settlement (FSKAR) ensures accountability in synchronous systems. In-kind settlement on Spain–Morocco works under its current institutional structure, but may not be compatible with future market coupling. Harmonisation will be necessary as the region evolves.

Conclusion and the way forward

Technical configuration, capacity calculation, congestion management, and operational best practices collectively define the performance and reliability of EU–extra-EU interconnections. The three case studies show that design choices are not interchangeable; each one suits a specific technical and geographical context. The MONITA HVDC link demonstrates how DC technology makes it possible to control power flows precisely over long undersea distances. The Türkiye–Greece–Bulgaria connections show that synchronous HVAC systems demand close real-time coordination as power flows follow the physics of the wider AC grid. The Spain–Morocco link, although an AC connection, behaves differently because the two systems are not fully synchronous, and therefore requires detailed stability assessments and a more customised operational approach.

Taken together, these three interconnections show that no single model can be applied everywhere. Each system’s operational behaviour is shaped by the technology used, the structure of the connected grids, and the institutional framework governing them.

Going forward, strengthening partnerships among TSOs, NRAs, and regional stakeholders will be critical to addressing existing barriers and advancing new projects. Adopting successful practices from existing interconnections, such as trading platform integration and the UIOSI principle, can enhance the design and implementation of upcoming initiatives.